The latest US jobs report released on Friday by Bureau of Labor Statistics (BLS) showed that the US economy is close to regaining all of the jobs lost due to the pandemic with unemployment at 3.6% compared to 3.5% at Feb 2020 . The underlying numbers such as the long term unemployed (without jobs for 27 weeks or more) and labor force participation (without jobs but actively looking) are also showing continued solid recovery; the long term unemployed moved down to 1.4 million and is now just marginally higher than Feb 2020 by 235,000. The labor force participation was 62.3% and is now 1.1% below the Feb 2020 level. Total employment remains just 440,000 below the pre-Covid level and may be exceeded next month given the current pace of jobs being added notwithstanding the headwinds of inflation and uncertainty of the war in Ukraine.

Where were the jobs added: The May 2020 showed that the US economy has been resilient to the war and inflation and added jobs in almost all of the sectors and the highest job increases occurred in leisure and hospitality, professional and business services and transportation while the only sector showing significant job losses was retail trade. However the retail sector currently employs 159,000 more people that it did prior to the pandemic in February 2020.

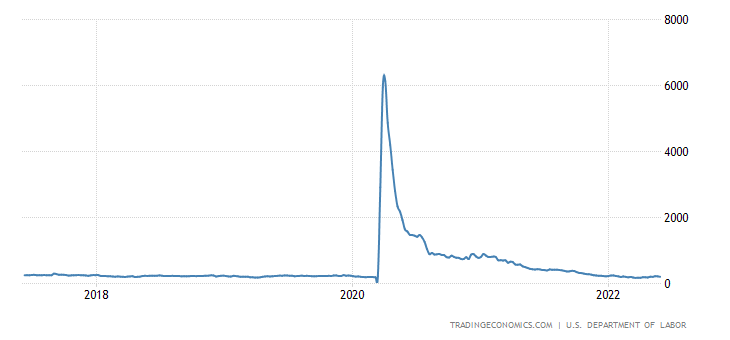

What was trend of Initial Claims and Average Hourly Earnings: Initial Jobless claims or the number of Americans filing new claims for unemployment decreased by 11 thousand to 200 thousand as shown below. In a similar vein, the Continuing Jobless claims which is a proxy for number of persons receiving unemployment aid from states also decreased to 1.3 million and both these numbers signal that the labor market continues to tighten and will add pressure to wages and inflation. This was reflected in average hourly earning increasing slightly and continuing to show an upward trend as it increased by 0.3% or 10 cents.

Where does this leave Fed’s Dual Mandate: The Fed has a well enshrined dual mandate of ‘price stability’ and ‘maximum sustainable employment’ which translates to keeping inflation rate at or below 2% as measured by the annual change in PCE (Personal Consumption Expenditures) and the median estimate of unemployment to be at 4% . With the latest jobs report, the drumbeat to tame inflation will become louder given that unemployment is below the Fed’s median target while the annual change of PCE has reached 6% after climbing down from 6.6% last month which was the highest level ever.

Side-Note – How is the US Jobs report put together: This is an interesting side note on how the US Jobs report which is published on the first Friday of every month is put together by the BLS. The US Jobs report by the BLS is based on 2 surveys; the household survey and establishment survey both of which produce sample-based estimates of employment. The former surveys households for things like unemployment and the latter surveys businesses and government agencies for things like jobs gained/lost; average hours and wages. The second survey or the establishment survey interviews about 130,000 employers across the country or about a third of all non-farm workers in the country and while some of employers complete the survey online a lot of it is done the old-fashioned way over the phone. In the last episode of the podcast, ‘Indicator from Planet Money’ the reporters went behind the scenes to show how the US Jobs report is put together and covered one of the 300 staffers employed by BLS who make calls to the businesses every month to complete the establishment survey.