It has been a long gap since I last wrote and much has happened in the financial world in these past few months (FTX trial, CZ arrest, Bitcoin resurge, inflation cooling, new Basel regulations etc). However I am starting from where I had left off in my last post which had observed common gaps between the two crypto banks that had collapsed in March leading to an upheaval in the banking system in spring of this year.

Eight months later, Basel Committee has released a post-mortem report on the 2023 banking crisis which is now recognized has having been the most significant and most severe since the Great Financial Crisis (GFC) of 2008; in 11 days in March 2023 four banks with total assets of $900 billion collapsed. The reason these failures did not result in a more widespread financial earthquake across the banking landscape was because of the robust capital buffers that has been enforced globally by regulators since GFC which allowed the other banks to absorb the shock from these banking failures and not cause a wide spread recession.

The Basel report goes into the causes of the failure of four banks – Silicon Valley Bank (SVB) and Signature Bank of NY (SBNY), First Republic Bank (FRC) and Credit Suisse (CS). The report notes fault-lines in risk management; governance and supervision in each of them and to save you from reading the entire report these are the key common factors contributing to failure of SVB, SBNY and FRC (CS had some unique risks mentioned later);

- Risk management failures were present in SVB, SBNY and FRS. At all three banks there was a rapid growth in last few years leading to a build up of assets and risk management did not keep pace with growth

- Board and Management were dulled by the growth at all of the three banks and failed to anticipate risks from rate rising and staying higher and did not see concentration and contagion risks of uninsured deposits and were complacent about both. FRC concentrated on High Net Worth individuals; SVB on VC firms and SBNY on on commercial real estate lending.

- Operational risk failures were present in both SVB and SBNY as they did not test processes to borrow from Federal Discount Window and tap into that contingency funding. This shows complacency and lack of foresight on account of their management.

- Supervisors failed to follow up after identifying material weaknesses in SVB and SBNY and did not enforce remedial actions to fix the weakness timely.

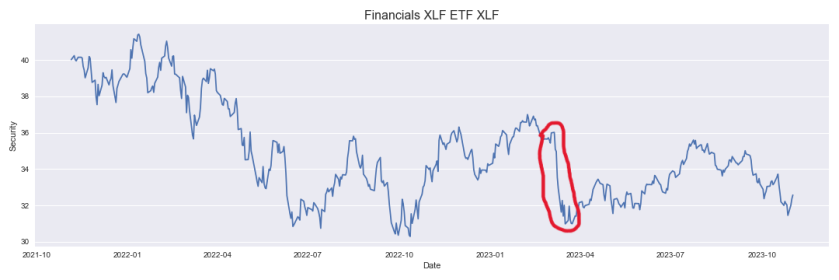

CS was different from these 3 banks since it did not have a concentrated uninsured deposit base like them and had a globally diversified business. However CS was in a weaker capital position relative to its peers and got caught up in the bank contagion after these 3 banks collapsed which caused a sharp decline in share prices for all banks (chart below).

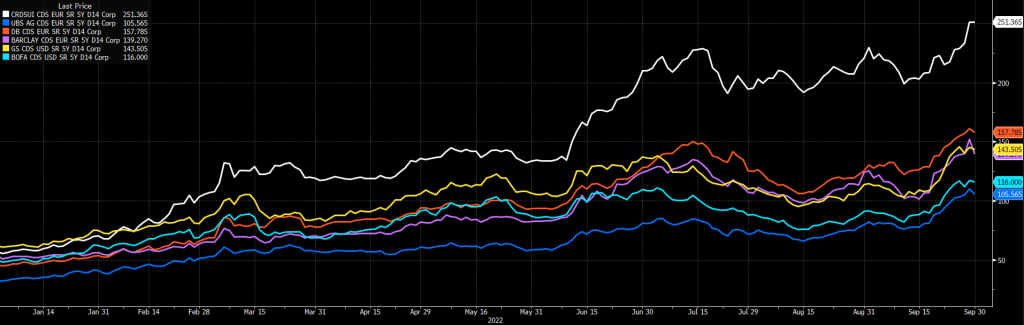

CS had weak governance and risk management which got exposed in 2021 through it’s involvement in two major financial scandals – Greensill and Archegos and resulted in significant supervisory enforcement actions. In Oct 2022 after two consecutive quarters of net losses, CS started experiencing renewed deposit outflow which caused it’s share price to drop more and increases in the cost of Credit Default Swap (CDS) protection as shown below where the cost of CDS protection for CS is the white line on top and as seen is much higher than it’s peer banks. The failure of the above three banks in US created another round of increased pressure on the already weakened CS stock price and CDS resulting in Swiss National Bank intervening resulting in forced union with UBS on March 19th.

What’s Next?

The design, scope and calibration of Basel III liquidity standards comes into questions since all three banks faced a liquidity crisis with pressure on stock prices and deposit outflows. As an illustration, just a day before CS collapsed the Swiss National Bank issued a statement that CS was meeting regulatory capital and liquidity requirements.

Currently in the US the IRBBB Basel framework does not apply to banks which have total assets below $250 billion and this was a contributing factor of the failures of the US banks as noted in last post. And so second point to address is more universal implementation of Interest Rate Risk in Banking Book (IRBBB) in the US and this has already been proposed by the FRB in July 2023.

Finally, one key insight from all these bank failures is that a rules-based approach like Basel framework to assess capital and financial solvency is unlikely to timely identify, assess and mitigate risks in a bank’s governance and risk management structure. This is not undermine the importance of capital rules but rather that the capital rules need to be supplemented by having sound risk management and a culture of governance and oversight that is proactive and a supervisory oversight which does not give undue weight to capital ratios against poor risk management.