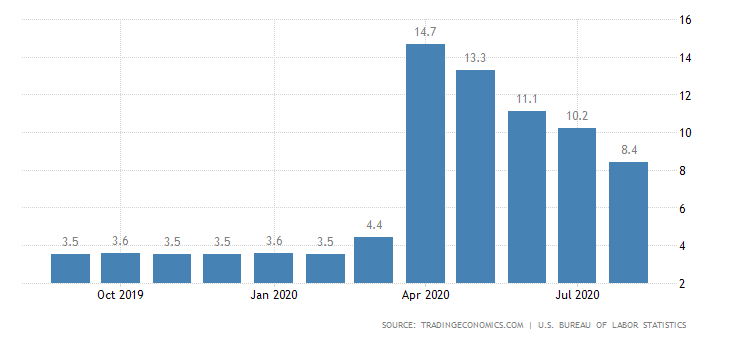

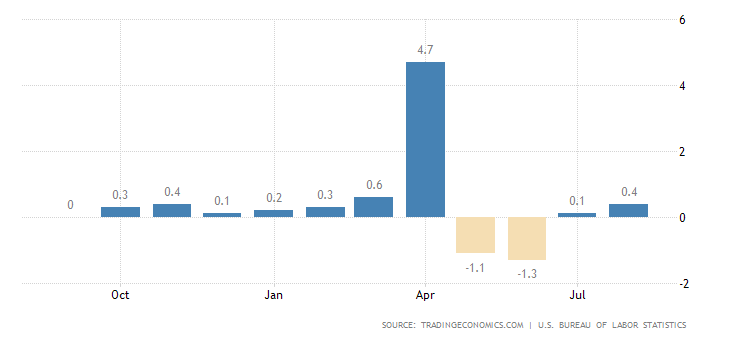

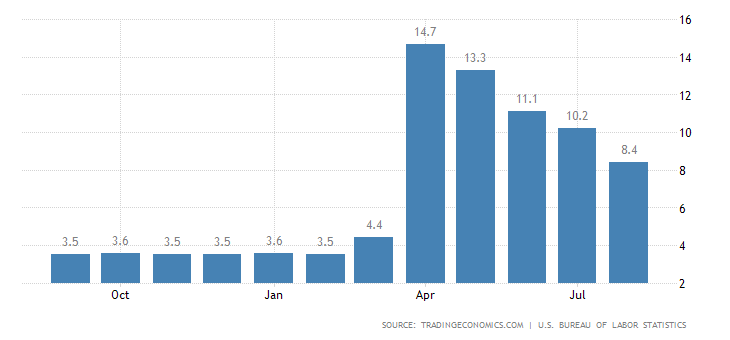

The US labor market continued to show signs of improvement with unemployment rate falling by 1.8% in Aug from previous month to 8.4% as the number of unemployed people fell to 13.6 million. Putting this drop in context; this was the 2nd biggest monthly drop in US unemployment after a 2.2% reduction that occurred in June 2020. However there are a three caveats to the impressive rebound; the highest increase in jobs was in the Government sector which added 344,000 jobs with most (238,000) increases being temporary due to hiring for the 2020 Census. Secondly, the number of permanent job losers continued to increase and rose by 534,000 to 3.4 million and now has risen by 2.1million since February showing that some of the job losses are not coming back. In a similar vein, the long-term unemployed (those jobless for 27 weeks or more) stood at 1.6 million and changed little since July.

Where were the jobs added – The highest job increases in Aug after the Government sector similar to July occurred in Retail followed by Professional/Engineering Services and then Leisure and Hospitality. This is to be expected as most job losses between March and May occurred in these sectors as they ground to a halt due to the impact of the pandemic. Most of the workers in the retail and hospitality/leisure industry are hourly wage workers and as a result, half of the overall new jobs added in Aug (approximately 600,000) were in the low wage sector with 150,000 new jobs in the middle wage sector and only 200,000 new jobs in high paying wage sector. Retail added 249,000 jobs in August with hiring occurring in general merchandise stores, car dealers, electronic and appliance stores as these places continued to open up. At current level, employment in retail sector is only 655,000 jobs below the level in Feb 2020. In contrast, even with the addition of 174,000 new jobs the Leisure and Hospitality sector still is 2.5 million jobs below the level in February. The Leisure sector remains vulnerable with most consumers still staying at home and avoiding large gatherings and some of this behavior could be sticky or even permanent; in addition the retail sector is also impacted by the state by state plans of re-opening the economy.

Still, the Aug BLS report was overall positive and there was even some surprises behind the headlines for the average hourly earnings which increased contrary to consensus and also an increase in the average weekly hours worked reversing a downward move in July.

- Average hourly earnings – In a surprise, average hourly earnings rose by 11 cents, or 0.4 percent in August of 2020 beating market expectations of no growth.

- Average weekly hours – In previous post, I had noted that in July, the average weekly hours had unexpectedly decreased from June which if continued could be worrisome but in Aug it increased back to 34.6 the level seen in June 2020.

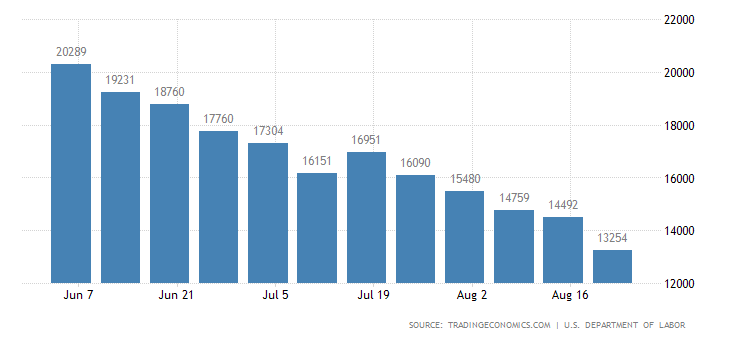

Initial weekly Jobless Claims and weekly Continuing Claims for the past weeks showed the trend of the economy slowly coming back but still having a long climb ahead to reach the the pre-pandemic levels.

Initial Jobless Claims: Weekly initial jobless claims fell by 130,000 in Aug to a new pandemic low of 881,000 as shown below and this is the first time that the number is below a million since the pandemic started in March but this is still abnormally high since prior to the pandemic the highest weekly initial claim amount was 695,000 in 1982. Also as been reported, some of the drop in the initial claims is due to a change made by Labor Department in terms of how seasonal adjustment is made for regular state claims.

Continuing Claims: In Aug, continuing jobless claims (unemployed people who have been receiving unemployment benefits for some time) decreased to 13.25 million and similar to initial claims is at the lowest level since the beginning of April.