This week Mortgage Bankers Association (MBA) second quarter 2020 delinquency report came out and the report showed that the number of homeowners who have missed three or more payments is now at a 10-year high. The amount of late Federal Housing Administration (FHA) loans rose to almost 16% in the second quarter up from about 9.7% in the previous three months; 16% late FHA loans is at now at the highest level since 1979 when the MBA started keeping records. This metric shows the devastating impact of the economy being shutdown due to the pandemic and how it has disproportionately impacted the lower income working population. The FHA provides mortgages insurance on loans made to those with low income and with weaker credit. When the pandemic started in March and the country entered lockdown, millions of low income wage earners lost their jobs in the retail and hospitality sector and stopped paying their mortgages taking advantage of the federal forbearance program; now about 3.6 million homeowners are in forbearance representing 7.2% of total FHA loans. The MBA report notes that while mortgage delinquencies increased in second quarter for all kinds of loans the impact was different across the income spectrum; delinquency rate increased by 307 basis points for conventional loans and increased 643 basis points for FHA loans showing greater impact on those with low income and weak credit. In aggregate, mortgage delinquencies across the country are at 8.22% were end of second quarter and rose by 3.86% from first quarter; this nearly 4 percentage point jump in the delinquency rate was the biggest quarterly rise in the history of MBA’s survey. However at the same time showing the uneven impact of the pandemic, the record low mortgage rates have increased mortgage borrowing by $63 billion in second quarter but more than 70% of these mortgage origination’s went to those having a credit score of 760 or higher.

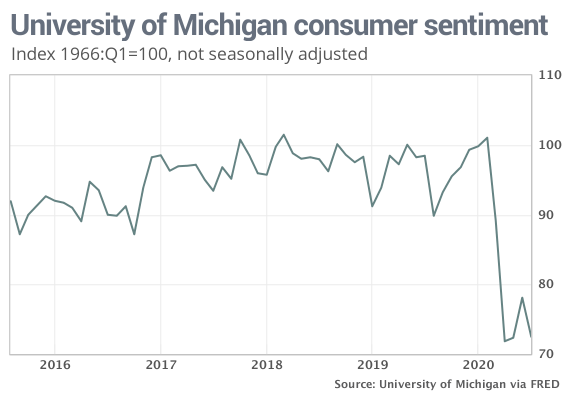

While the job market showed signs of improvement in July, outlook remains uncertain with increase in infections in different states that opened early and a decreased confidence of uninterrupted re-opening. This was reflected in the consumer sentiment; the consumer sentiment survey for August rose marginally to 72.8 from 72.5 in July but it is just slightly above the pandemic low as shown below. Most households have low confidence in the current state of the economy and the index that measures current attitude slipped to 82.5 from 82.8. Expectations for the next six months rose slightly to 66.5 from 65.9 showing that most Americans think it will be years before the economy returns to normal. An overarching concern is household anxiety and fears of missing mortgage payments and rents in the coming months.

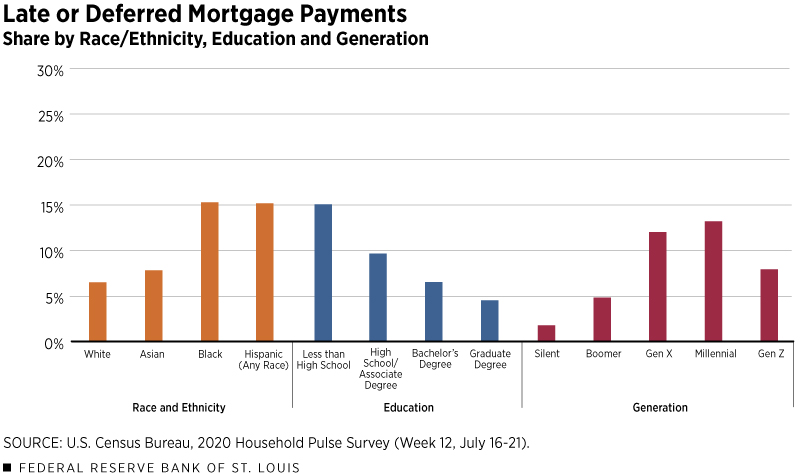

A pandemic specific survey labelled Household Pulse Survey being done by the Census Bureau to assess impact of the pandemic on the American households shows the extent of the economic pain and also concerns of it persisting or increasing in the coming months. The survey notes that around 50% of the working population in US has had a loss in employment income in the 12 weeks since the pandemic started in mid-March and in some states almost a third of the renters and mortgage owners expect to miss their rents and mortgage in August. Similar to the data in the MBA report the economic pain is unevenly distributed and is much higher not surprisingly for Black or Hispanic, those that lack a college degree and are part of Generation X, Millennials and Generation Z as noted in a blog post by the St. Louis Fed staff.

While so far, foreclosures and evictions have been stopped temporarily, the payments for the loans in forbearance are going to come due without any further extension in deferral period or additional government stimulus and this will cause more anxiety since the borrowers and renters now have a lump sum due after an extended period of subdued earnings. With the pandemic continuing and the outlook for the economic recovery not very certain, the distress in the mortgage sector has more to pain to come.