Time famine is a mental feeling of being starved for time; feeling there is not enough time to do everything that we want to do and being in a state where the time is always less and the to-do list always longer. Despite the challenges posed by our modern day overbooked schedules and pervasive technology, there steps that all of us can take to overcome Time Famine and get to a state of Time Affluence.

State of US Banks – Dec 2023

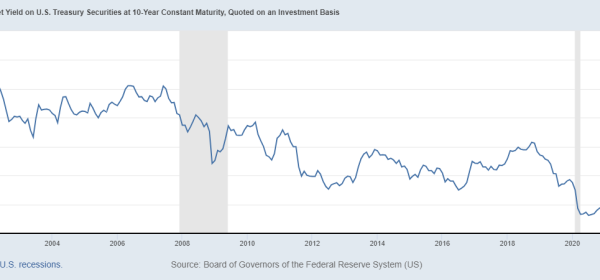

OCC released their semi-annual report, Semiannual Risk Perspective for Fall 2023 last week on the state of the banking industry in the US and notes that state of banking industry remains sound but challenged while the economic headwinds are receding due to strong consumer spending, strength in labor market and resilient resilient corporate profits. However the report highlights challenges that inflation remains above long term goal (2%); job growth is slowing and warns that consumer savings have been depleted due to strong spending and end of pandemic assistance. This is a summary of some interesting nuggets from the report;

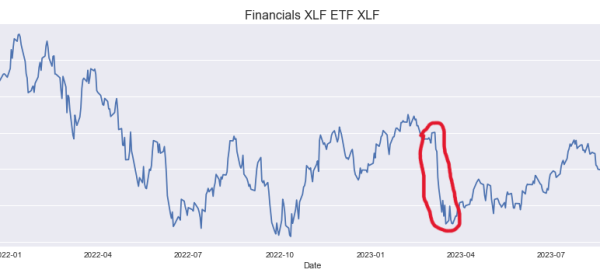

Post Mortem on 2023 banking crisis

Basel Committee has released a post-mortem report on the 2023 banking crisis which is now recognized has having been the most significant and most severe since the Great Financial Crisis (GFC) of 2008; in 11 days in March 2023 four banks with total assets of $900 billion collapsed.

Falling of the Crypto Banks – phase 2

The collapsing dominoes of crypto have reached the crypto banks with Silvergate and Silcon Valley Bank (SVB) closing last week. There are three common factors behind the 2 bank failures this week. Both banks failed to implement proven risk management practices present in the banking industry of managing concentration risk, interest rate risk, asset-liability mismatch and were woefully inadequately prepared for a bank run and reacted to the fast pace of rate increases and deposit withdrawls.

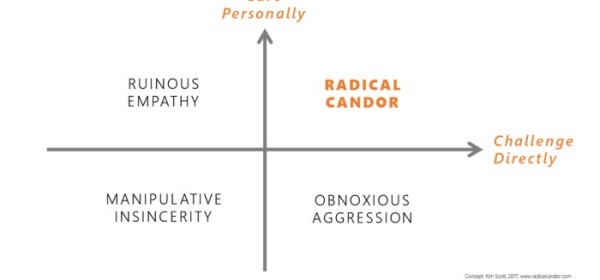

Summary of Radical Candor by Kim Scott

Summary of Radical Candor by Kim Scott – Key insight behind Radical Candor is that command and control can hinder innovation and harm a team’s efficiency and that collaboration and innovation flourish when human relationships replace bullying and bureaucracy.

State of Banks in the US – OCC Annual Report

Office of Comptroller of currency (OCC) released the 2022 annual report providing state of the US banking system. In their report, the OCC concludes that the US banking industry remains well capitalized with ample liquidity and is well positioned to face the continuing geopolitical & economic uncertainty and market volatility which was also reflected in the views of the Bank CEO’s in the earnings calls last week.

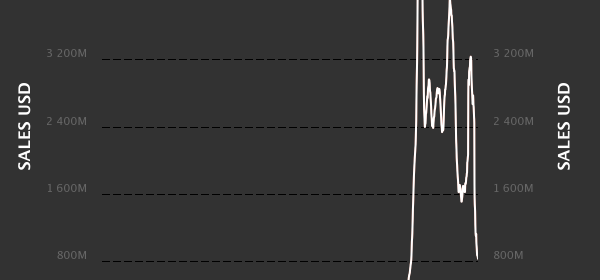

Falling of the crypto banks

The dominoes continue to collapse in the crypto world with the turn of the crypto banks and lenders now. Over the summer, Crypto banks Celsius, Vauld and broker dealer Voyager have all suspended withdrawals and are in various stages of bankruptcy. These are the latest dominoes to fall in the crypto world as the price of bitcoin has dropped by 50% from last year and is down 69% from its all time high.

State of Banks in 2022

OCC (Office of Comptroller of Currency) which supervises national banks and agencies of foreign banks in US released their semi-annual risk report last week. The report presents key issues facing banks that “pose threats to the the safety and soundness of banks and their compliance with applicable laws and regulations”. The report presents an optimistic message – while the risk of downside growth is increasing due to tightening financial conditions and geopolitical uncertainty the banks continue to be financially strong having navigated the pandemic and are well capitalized to face the economic headwinds.

What happened to NFT’s?

2021 saw a huge increase in price and popularity of Non-Fungible Token (NFT) which tracked the rise in cryptocurrencies and stock market and 2021 was the year that NFT’s became mainstream with celebrity endorsements. However in 2022, NFT’s have declined with cryptocurrencies and dropped in price and volume along with other asset classes as interest rates have risen. But there is wide potential use of NFT that has not yet been explored and it looks like NFT’s will stay as an asset class and a will have a major role in the digital asset ecosystem.

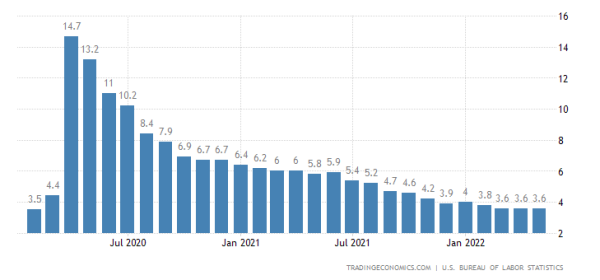

A solid US Jobs Report for May 2022!

The latest US jobs report released on Friday by Bureau of Labor Statistics (BLS) showed that the US economy is close to regaining all of the jobs lost due to the pandemic with unemployment at 3.6% compared to 3.5% at Feb 2020

The Fed Bitcoin Part II

Background: This year prior to starting the war on inflation, the Fed published a paper asking for comments on a Fed coin or a CDBC

The violent death of TerraUSD and Luna!

The $49 billion meltdown of the algorithmic stablecoin Terra USD (UST) coin and it’s lined token, Luna this month has shown the shaky grounds on which the lofty valuations of stablecoins have been built. Terra which has fallen in value from being pegged to USD to less than 5 cents and Luna which was one of the top 10 stablecoins in Jan is now worth less than 1 cent. The death of Terra and Luna has also led to a $300 billion decline in the crypto industry.

Stablecoins – Presidents Working Group (PWG) report

Earlier this month, the Presidents Working Group on Financial Markets (PWG) released a report on Stablecoins. This represents first attempt in designing prudential safeguards for stablecoin issuers.

2021 Bain Tech report

The consulting company, Bain & Company (‘Bain’) released their second annual Technology report recently. There are 3 main patterns identified; (1) Tech is the main disruptive force now in every sector

(2) Cloud Computing will have an extraordinary impact in coming years causing an unbeatable edge for those companies already ahead (Apple, Amazon, Facebook, Microsoft, Alibaba, Tencent). (3)

Geopolitical and regulatory influences on tech companies are more important than before.

Grey Swans and Gray Rhinos in land of Risk Management

What are Grey Swans and Gray Rhino’s in the world of risk management? Gray Swans are used to describe events that are possible but not considered likely to happen and that have extremely significant impact. Gray Rhino, this is the Elephant/Gorilla in the room and is an event that is highly probable, has high impact but crucially is a neglected threat.

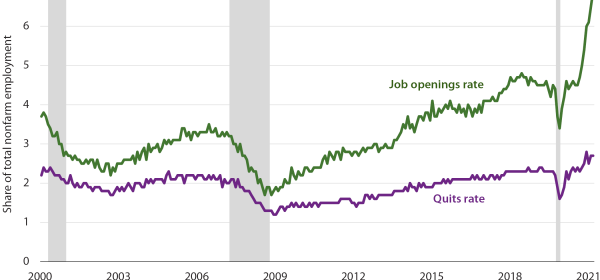

Why this economic recovery from Covid is so different?

Why this economic recovery from Covid is so different? While there has been a sharp and quick recovery to pre-pandemic levels aided by fiscal support there are notable signs in inflation, wage growth, inventory supplies and spending patterns that make this recovery look very different from the previous economic recoveries.

DNA effect of BiG Tech

What is the DNA effect? The DNA effect is the ability of large technology companies to build a competitive advantage by leveraging user generated data in their networks. DNA in this context stands for ‘data-network-activities’ and refers to how the business model of large technology companies (like Google, Apple, Facebook, Alibaba, Tencent aka Big Tech) depends on direct interactions of users which generates lost of data and the ability of these companies to use this data to scale up operations and enter into new areas like financial services.

The Archegos FIASCO AT CSFB

An inside view on what was going on inside Credit Suisse that led the bank to have the biggest losses of $5.5 billion amongst major banks from the collapse of Archegos

Future of Work

The popular view that emerging technologies like Artificial Intelligence (AI), Robotics will dramatically improve our personal and professional lives usually gets contrasted against the threat of the millions of jobs that are at risk from automation. Against this backdrop, a report last year based on a three year study by MIT offers a balanced perspective on the relationship between these emerging technologies and future of work and the labor market.

FRB bitcoin

Reality of a central bank digital currency (CDBC) is coming closer. However the development of a CDBC is said to pose the biggest threat to banks in developed economies like US?

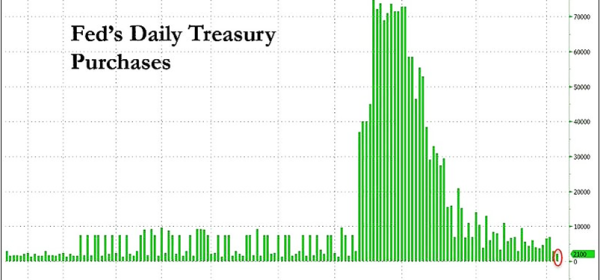

March 2020 Crisis – view from Fed

Recent speech by FRB governor Lael Brainard and the Nov 2020 Financial Stability Board report shine light on the depth of the market turmoil last year and also point to the fact that it would have been much worse if the central banks had not intervened.

2021 NASDAQ Tech Trends report

The annual Nasdaq report highlights 4 most important trends that will have an impact in coming year

Insights from ‘Good to Great’ the masterpiece by Jim Collins

Summary of ‘Good to Great’ by Jim Collins. Can a Good company become Great and if so How? The transition from Good to Great has 3 blocks – Disciplined People; Disciplined Thought and Disciplined Action and the key point across all 3 blocks is Discipline. To go from a good organization to a great one you need disciplined people, disciplined thought, and disciplined action.

2021 Global RIsk Report

Climate risk is now the most prominent risk both in terms of likelihood and impact as noted in the 2021 Global Risk report by the World Economic Forum.

IMF Global Outlook – 2021

This week, the International Monetary Fund (IMF) released their latest forecast which predicts that world GDP will grow by 5.5% in 2021 against a net decline of -3.5% seen in 2020. IMF foresees that first half of 2021 will see softer growth and the growth momentum will increase in the second half. The rebound in 2021 is based on the twin-punch of a ‘vaccine-powered’ recovery coupled with policy support in large economies.

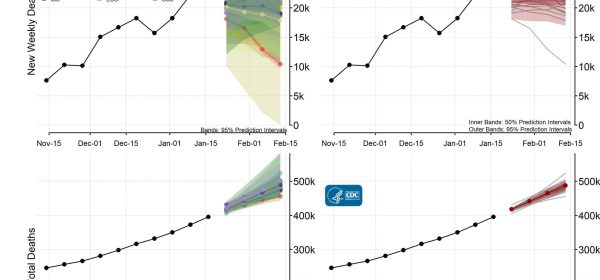

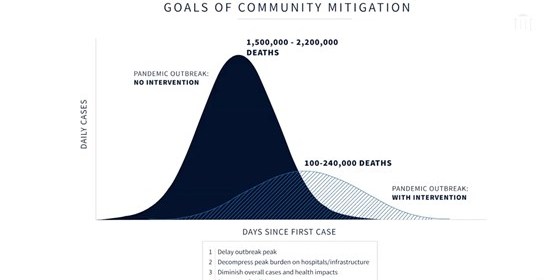

CDC’s Ensemble Forecast model for COVID-19

Looking behind the curtain of CDC’s Ensemble Forest model for forecasting deaths from Covid-19

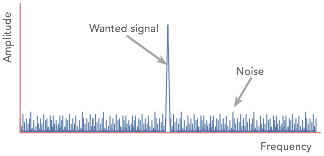

predictive performance of the covid-19 Models

What is the error in the estimates of the popular Covid-19 models and what can we conclude from that insight?

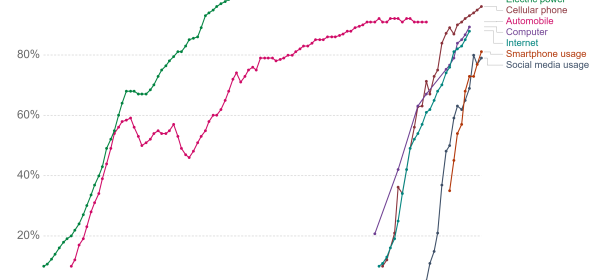

Technology ADOPTIOn – FASTER & shorter

The pace of technology adoption is getting faster and the time period for a new technology to become mainstream is getting shorter – it took 40 years for electrical power to be present in 90% of US households but only 24 years for computers and 10 years for social media usage.

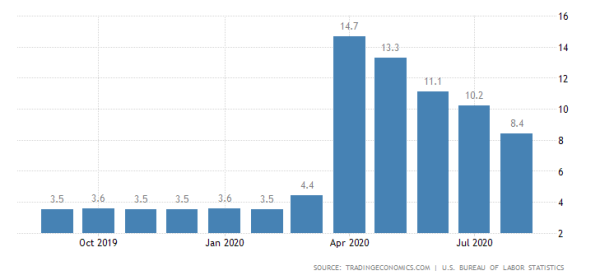

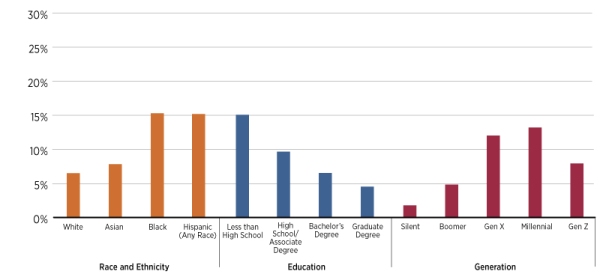

Looking at the US Aug Unemployment report

The US unemployment report for Aug showed the 2nd biggest monthly drop in US unemployment after a 2.2% reduction that occurred in June 2020. However there are a three caveats to the impressive rebound; biggest increase was driven by temporary hiring for 20202 Census and the permanent job losses continued to rise while the number of long term unemployed hardly moved.

Mortgage DELINQUENCIES RISE WITH the Pandemic

The share of mortgages that are 90 days past due is now at a 10-year high and almost a third of the homeowners expect to miss their payments in coming months in some states.

Junk Bonds, Leveraged Loans and CLO’s

Junk Bonds Second quarter 2020 had a massive amount of debt issuance across High Yield (HY) and Investment Grade (IG) ratings and the month of

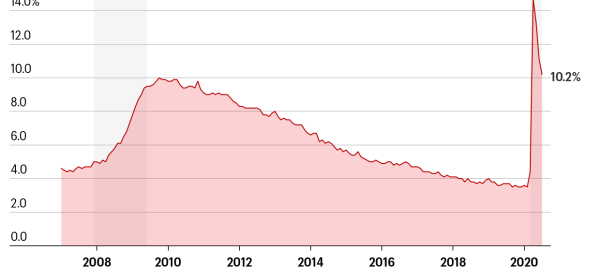

US Monthly Unemployment

US Jobless claims and monthly unemployment data There is an expectation that the worst of the economic effects of the pandemic are behind us and

The Signal and the Noise

Insights from ‘The Signal and the Noise’ by Nate Silver – on overfitting models, confidence of forecasters and challenges of economic forecasting and biases in prediction.

Summary of ‘Prediction Machines – the Simple Economics of Artificial Intelligence’

Summary of ‘Prediction Machines – the Simple Economics of Artificial Intelligence’ by Ajay Agrawal, Joshua Gans, and Avi Goldfarb

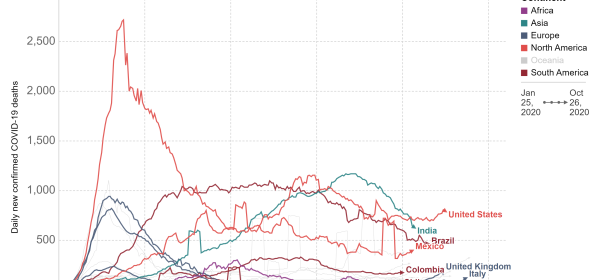

The impact of the Global Coronavirus Recession

The impact of healthcare crisis, coronavirus aka Covid-19 has been devastating with more than 119,000 deaths worldwide as of April 11. This healthcare crisis has

Coronavirus projection models

The impact of Covid-19 on our lives has been profound and unprecedented both socially and economically. As more countries implement implement social distancing, now a

FRB and IMF – Cyber attack is a systemic risk to financial system

In January this year, the Federal Reserve Bank (FRB) published a working paper which assessed impact on the financial system from a hypothetical cyber attack

Review of the 2019 World Economic Forum report on ‘Responsible Innovation with AI in Financial Services’

A summary of the 2019 World Economic Forum report on key obstacles preventing AI from being fully adopted and transforming the financial sector.

ML Implementation – lessons from Booking.com

Business lessons learnt by the data scientists at Booking.com after deploying 150 Machine Learning (ML) models. These observations are insightful and offer a practitioner view regarding implementation of ML models for business purpose and some are even non-intuitive.

Regulatory Expectations for use of AI in financial sector

Another month and another publication on Artificial Intelligence (AI) by regulators is out. This time it is by the De Nederlandsche Bank (DNB). The principles

Machine Learning (ML) & Anti-Money Laundering (AML) – made for each other

Money laundering is a massive drain on the world’s financial, legal and economic institutions and current rule based AML controls with a false positive rate of 90% are just not adequate to detect and monitor them. AML is ripe for disruption and innovation through use of Artificial Intelligence (AI) and Machine Learning (ML) and even the regulators are encouraging the same. Key areas of AML where AI and ML have been shown to work through recent published papers are risk scoring; customer segmentation and transaction monitoring using clustering (k-means); classification (support vector machines) and deep learning (graph convolutional networks). These approaches shows us a glimpse of the near future state of AML controls and how new technology can help solve the seemingly insurmountable problem of money laundering as it exists now.

Machine Learning Explainability – QII, Shapley Values and Data Shapley

Introduction: One of the key challenges of using machine learning (ML) is the lack of explainability which progressively decreases as the model complexity increases starting

Model Risk – view from Actuarial Industry

View of model risk from the actuarial industry with some unique insights into types of model users and how they impact model risk and expected vs unexpected model risk error.

China’s Central Bank Digital Currency

In an announcement this month that went under the radar due to the US-China trade war grabbing the headlines, the People’s Bank of China (PBoC) announced

Digitization of Cybersecurity

In a new July 2019 report titled “Cybersecurity: Linchpin of the digital enterprise”, McKinsey emphasizes that cybersecurity must support the digital agenda of the company. In

How we consume digital news?

Fascinating publication by Reuters on how the world is consuming digital news – watch the 3 minute clip if you don’t have time to read the report.

https://www.youtube.com/watch?v=gtkiRJwSN10&feature=youtu.be

Money – cash, digital, crypto and more…..

I came across a short and stimulating article by the IMF staff on current state of digital and paper money which identifies essential, conceptual features of all payment types and based on that categorizes them into 5 types. From the paper, I took away three main insights -first there is a compelling argument that traditional forms of payment transactions by banks (referred to as B-Money) will face intense competition from electronic money (or E-Money) in coming years; this will obviously hurt the profitability of the banks given that all retail banks are rely primarily on deposits for funding and will create further disruption in the banking sector. Second, the article conjectures that eventually banks could be forced to offer electronic money or similar products and we can see that happening already with JP Morgan dipping toes into digital money waters by offering JPM Coin by end of 2019. Lastly, role of the central banks will be pivotal as they could jump into the fray and offer central bank digital currency (being explored by Sweden, Uruguay, China, Thailand, Japan and South Korea) and also shape the environment and the pace of innovation for digital money.

AI in Finance – a report by the Alan Turing Institute report

A recent report by the Alan Turing Institute notes that use of AI in Finance in financial services will impact 4 principal areas – fraud detection; use of chatbots; algorithmic trading and increase in regulatory and policy making. The report makes for a good read and while the first three use cases are credible there is skepticism about the impact AI/ML will have on algorithmic trading. In this post I have included a short summary of the report with an assessment and critique of the 4 areas with supporting links to relevant articles.

TRIM interim results – April 2019

Background Targeted Review of Internal Models (TRIM) is a regulation under ECB (European Central Bank) which is designed to bring common understanding and consistency across